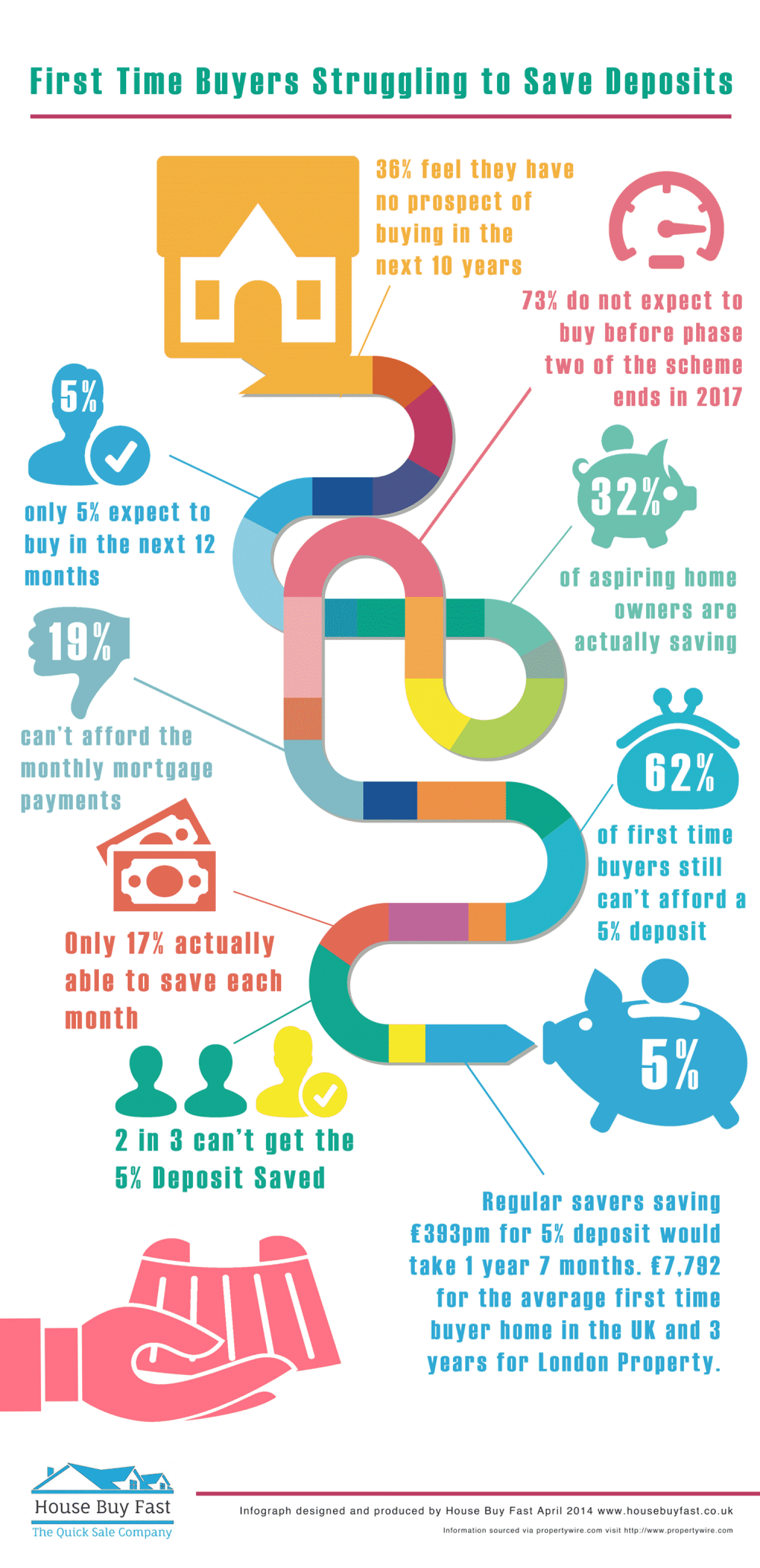

We’ve produced an infographic about how first time buyers are struggling to save deposits. With thanks to PropertyWire.com for the research that they carried out.

A Quick Overview

- 36% feel they have no prospect of buying in the next 10 years

- 73% do not expect to buy before phase two of the help to buy scheme ends in 2017

- 5% expect to buy in the next 12 months

- 32% of aspiring home owners are actually saving

- 19% can’t afford the monthly mortgage payments

- 62% of first time buyers still can’t afford a 5% deposit

- 17% actually able to save each month

- 2 in 3 can’t get the 5% deposit saved

- Regular savers saving £393 a month for 5% deposit would take 1 year 7 months. £7,792 for the average first time buyers home in the UK and 3 years for London Property.

![First Time Buyers Are Struggling To Save Deposits [Infographic]](https://housebuyfast.co.uk/wp-content/uploads/2021/06/211_first-time-deposit-infographic.jpg)