Bought a House with Problems Not Disclosed UK? Effective Steps to Take

Introduction to Buying a House

Location or number of bedrooms – unexpected problems can turn what should be an exciting move into a costly headache. Whether you buy a house with structural damage, legal disputes, or hidden damp, these issues can lead to major expenses down the line.

In the UK, the legal principle of “caveat emptor”, or “buyer beware”, still applies. This means the buyer takes on the risk once contracts are exchanged, so it’s vital to ask questions, read documents carefully, and be alert to any red flags.

While sellers are expected to disclose known issues, the burden largely falls on buyers to carry out checks before agreeing to the sale. Understanding your rights and being aware of what the seller is expected to share can make all the difference.

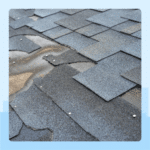

One of the most effective ways to protect yourself is by commissioning a professional property survey. This can reveal problems that aren’t obvious during a viewing -from roofing defects to signs of subsidence. Catching these early can help you renegotiate the price or decide to walk away altogether, potentially saving you thousands.

Understanding Seller’s Legal Responsibility

When buying a flat or house in the UK, it’s not just about what you see on the surface. Sellers have a legal duty to be honest about any known issues with the property, and this responsibility forms a key part of the sales process. If a buyer believes the seller misrepresented the condition of the property, they should consult a solicitor specialising in property law.

One of the main tools for disclosure is the Property Information Form (TA6). This is a standard form completed by the seller, covering a wide range of topics such as structural problems, neighbour disputes, boundary issues, and even questions about whether planning permission has been obtained for any alterations. It’s not a form to be taken lightly – misleading or incomplete answers can have serious consequences. Property misrepresentation can occur if sellers fail to disclose known issues, leading to potential legal actions from buyers.

If a seller knowingly withholds or lies about problems, they could be taken to court for misrepresentation. The buyer may be able to claim compensation, or even unwind the sale in some cases, especially if the issue is severe enough to affect the property’s value or habitability. Buyers may pursue a misrepresentation claim if sellers provide false information or fail to disclose significant issues.

That said, the legal framework still expects buyers to take responsibility for doing their own checks. It’s wise to ask direct questions and push for clarity before the exchange. If something doesn’t seem quite right – for example, vague answers on the TA6 form or reluctance to provide documents – it may be a sign to dig deeper or seek legal advice. The TA6 Law Society form requires that the seller disclose any significant problems or vital information about the property to avoid claims of misrepresentation.

Significant legal and financial repercussions arise when a seller fails to disclose known issues with a property.

Property Information and Disclosure

The Property Information Form (TA6) plays a key role in the home-buying process. It’s designed to give buyers a clearer picture of what they’re purchasing, beyond what’s visible during a viewing. Sellers are expected to complete it truthfully, disclosing any known problems or restrictions that could affect the property. How sellers disclose this information through the TA6 form is crucial for transparency and trust.

The form covers a wide range of topics. Sellers must declare any structural issues, such as subsidence or previous repair work, as well as natural risks like flooding. Legal matters are also included – for example, if there are disputes with neighbours, shared access rights, or restrictions on how the property can be used (known as covenants). Sellers must be transparent about any legal problems to avoid legal repercussions.

Other areas covered include whether the property complies with building regulations, if there have been any problems with planning permission, and whether there are guarantees or warranties in place for recent work. Disclosing ongoing disputes is also important to avoid potential legal consequences.

Providing accurate details on the TA6 form isn’t just a legal requirement, it helps prevent disputes later on. Buyers rely on this document when deciding whether to proceed and on what terms. If the information turns out to be false or misleading, the seller could face serious legal consequences, including legal action and compensation claims.

A well-completed TA6 form builds trust and helps move the sale forward smoothly. On the flip side, vague or incomplete answers should raise a red flag and prompt further investigation.

Consumer Protection and Rights

Buyers in the UK aren’t left entirely to fend for themselves – there are protections in place when it comes to misleading information. The Consumer Protection from Unfair Trading Regulations 2008 makes it illegal for sellers or estate agents to give false details or leave out key facts that would affect a buyer’s decision. Buyers have legal recourse under the Misrepresentation Act 1967 if they can prove they were misled about the property’s condition.

This includes anything that might sway the sale, such as hiding problems with the structure, exaggerating room sizes, or failing to mention planning disputes. Even omissions can be a breach of the law if they cause someone to go ahead with a purchase they otherwise might not have made.

Estate agents, in particular, are under pressure to get things right. They must give accurate details about the Energy Performance Certificate (EPC), council tax band, and whether there’s off-street parking. If an extension has been added, they need to confirm that it was done with proper permissions. Misleading information on any of these can be grounds for legal action.

If a buyer suffers a financial loss because of something they were told – or not told – they may be able to seek compensation. This is where the Misrepresentation Act 1967 comes in. It offers legal remedies to anyone who has entered into a contract based on incorrect information, even if the person giving it wasn’t acting maliciously.

The bottom line? Whether it’s the seller, the estate agent, or even a surveyor, those involved in the sale are expected to act honestly. If they don’t, the law may be on the buyer’s side. Failing to disclose significant property issues can lead to potential legal trouble under the Misrepresentation Act.

Surveyor’s Role and Importance

A surveyor plays a crucial role in the home-buying process, acting as a safeguard against potential pitfalls. Their expertise helps identify any structural defects or hidden issues that might not be immediately apparent during a standard viewing. This is particularly important in uncovering undisclosed problems that could lead to significant financial burdens down the line.

The surveyor’s report provides a detailed assessment of the property’s condition, highlighting areas that may require attention or repair. This information is invaluable for buyers, as it can be used to negotiate with the seller, potentially leading to a reduction in the purchase price or requiring the seller to address the issues before the sale is finalised. In some cases, the findings might even prompt a buyer to reconsider their decision to proceed with the purchase.

Choosing a reputable and experienced surveyor is essential to ensure an accurate and comprehensive report. A well-conducted survey can reveal issues such as damp, subsidence, or roofing defects, which might otherwise go unnoticed. By identifying these problems early, buyers can avoid costly surprises and make informed decisions about their investment.

Moreover, in situations where buyers discover undisclosed problems after purchasing a house, the surveyor’s report can serve as crucial evidence to support a claim against the seller. This can be particularly important in legal disputes, where proving that the issue existed at the time of purchase is necessary for seeking compensation.

In summary, a surveyor’s role is not just about assessing the property’s current state but also about providing peace of mind and protecting the buyer’s financial interests.

Exchanging Contracts and Completing the Purchase

The point at which contracts are exchanged marks a key milestone – once this happens, the agreement becomes legally binding. At this stage, walking away without a good reason could mean losing your deposit or facing legal action. That’s why it’s so important to be confident that everything checks out before signing on the dotted line.

The conveyancing process – the legal transfer of ownership – can be detailed and at times confusing, especially for first-time buyers. A good property solicitor can make all the difference. They’ll review contracts, raise enquiries with the seller’s solicitor, and ensure you’re aware of any restrictions or conditions tied to the property. This includes looking for errors, hidden clauses, or anything unusual in the title deeds.

It is crucial to consult a property solicitor before exchanging contracts to ensure that all legal matters are addressed and you are fully aware of your obligations once legally bound.

Buyers need to be especially mindful of information gaps or unanswered questions. If something hasn’t been fully explained – whether it’s a vague answer on the TA6 form or missing paperwork for building work – it’s best to push for clarity before proceeding.

Legal disputes can arise after the sale if it’s discovered that key information was withheld. To help avoid this, your solicitor will often ask the seller’s side for written confirmation that no known issues have been hidden. If anything is later found to have been misrepresented, this documentation becomes crucial for making a claim.

Buying a home is rarely straightforward, but having the right support in place can make it far less risky – and give you peace of mind that you’re making a sound investment.

Insurance Considerations

When buying a house, it’s essential to consider various insurance options to protect against potential risks and financial losses. Buildings insurance is a fundamental policy that covers structural issues, such as damage to the property’s foundation, walls, or roof. This type of insurance ensures that buyers are not left out of pocket if significant repairs are needed due to unforeseen events.

Contents insurance is another important consideration, as it protects personal belongings against loss or damage. This can include everything from furniture and electronics to clothing and jewelry. Having contents insurance provides peace of mind that your possessions are covered in case of theft, fire, or other incidents.

For those concerned about professional advice and services, professional indemnity insurance is worth considering. This type of insurance protects against claims of professional negligence, ensuring that buyers are covered if they suffer financial losses due to incorrect or misleading advice from professionals involved in the purchase process, such as surveyors or estate agents.

Insurance can provide buyers with a safety net, offering financial protection and reducing the stress associated with potential problems. However, it’s crucial to carefully review insurance policies to understand what is covered and what is not. Policies can vary significantly, and some may have exclusions or limitations that could affect coverage.

Seeking advice from a professional insurance broker can be beneficial in ensuring that you have the right level of coverage for your needs. Brokers can help navigate the complexities of different policies and recommend the best options based on your specific circumstances.

In conclusion, considering various insurance options and seeking professional advice can help buyers protect their investment and provide peace of mind as they navigate the home-buying process.

Legal Fees and Costs

Buying a house doesn’t just involve the sale price – there are several additional costs that buyers need to plan for, and legal fees are a big part of that. From conveyancing to surveys and potential disputes, having a clear understanding of the likely expenses can help you avoid nasty surprises.

Legal costs can vary depending on the complexity of the purchase. A straightforward sale with no leasehold complications might be cheaper, while buying a leasehold flat, or a home with legal restrictions or shared access, may require extra legal work – and come with a higher bill.

If problems emerge after the sale – such as hidden structural issues or legal disputes – the cost of putting things right can rise quickly. Repair costs, legal consultations, and in some cases, litigation, can all be expensive. Courts may hold sellers accountable for covering repair costs associated with undisclosed structural or maintenance problems, emphasizing the financial implications for sellers if significant issues are discovered post-sale. A professional negligence claim, for example, can involve court costs and solicitor fees, and may take months to resolve.

To help manage these risks, buyers are strongly advised to invest in a building survey. While this adds to upfront costs – often a few hundred pounds – it can help uncover problems early, giving you the chance to renegotiate the price or walk away entirely. Compared to the cost of repairing a cracked foundation or dealing with damp, a good survey is often money well spent.

Factoring in these costs from the start – and not just focusing on the sale price – will give you a much clearer view of what the property is really going to cost.

Resolving Disputes and Seeking Compensation

Sometimes, even with all the right checks in place, buyers only discover serious problems after moving in. If it turns out that key issues were hidden or misrepresented, it may be possible to claim compensation, particularly if the fault should have been disclosed during the sale.

The Misrepresentation Act 1967 offers a route for buyers to claim damages if they’ve suffered a financial loss because of false or misleading information. This could apply whether the seller gave incorrect details, failed to mention a known problem, or answered questions dishonestly on the TA6 form. In many cases, buyers can also make a legal claim against estate agents or surveyors if their actions led to an unfair sale.

To bring a successful case, it’s essential to gather evidence. A property survey carried out before the sale – or one commissioned afterwards to confirm the issue – can help prove that the problem existed at the time of purchase. Keeping written records of what was said (or not said) by the seller or agent can also support your position.

If you find yourself in this situation, the first step is to get proper legal advice. A solicitor can review your case and explain whether you’re likely to have a claim, and what compensation might be available. In some situations, this can even include the cost of repairs or a reduction in the property’s value.

While no one wants to deal with legal action after buying a home, knowing your rights — and having the right support — can make all the difference. Pursuing legal action can vary based on the particulars of the case, the evidence presented, and legal interpretations.

Conclusion

Buying a house only to uncover hidden problems afterwards can be a stressful and expensive experience. What starts as an exciting new chapter can quickly become a financial burden, especially if the issues were avoidable. Being diligent during the sale process is crucial to uncovering any hidden problems early on.

That’s why it pays to be thorough. From asking the right questions and reviewing the Property Information Form (TA6) to commissioning a professional survey and seeking legal advice, each step plays a part in protecting your interests.

Understanding your rights and the responsibilities of the seller and estate agent puts you in a stronger position. It helps you spot warning signs, avoid costly surprises, and make decisions with confidence.

While the principle of “buyer beware” still applies, being proactive can mean the difference between a smooth move and a legal battle. And when problems do arise, knowing the steps you can take may help you recover what’s fair — and move forward on firmer ground. Failing to disclose significant property issues can lead to serious legal consequences, emphasizing the importance of transparency and honesty in the property sale process.